Second home mortgage qualification calculator

In addition to your down payment and mortgage default insurance you should set aside 15 - 4 of your homes selling price to cover closing costs which are payable on closing day. The actual amount will still depend on your affordability.

Mortgage Down Payment Calculator Ratehub Ca

One factor this calculator does not take into account is capital gains.

. BACK END RATIO FORMULA. Check out the webs best free mortgage calculator to save money on your home loan today. We used the calculator on top the determine the results.

The longer term will provide a more affordable monthly. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Then once you have calculated the payment click on the Printable Loan Schedule button to create a printable report.

Freddie Mac offers 2 low down-payment mortgage options. Two months of payments in cash reserves. The total second mortgage debt outstanding went above a trillion dollars in early 2006.

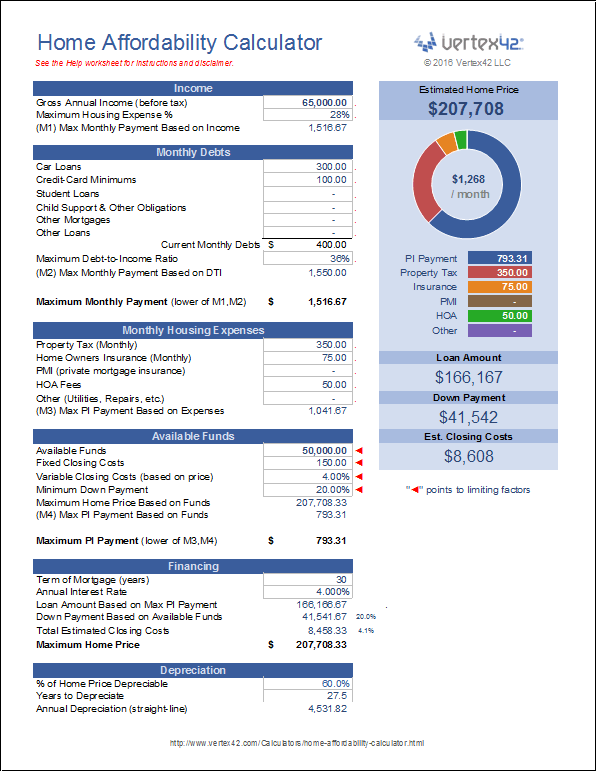

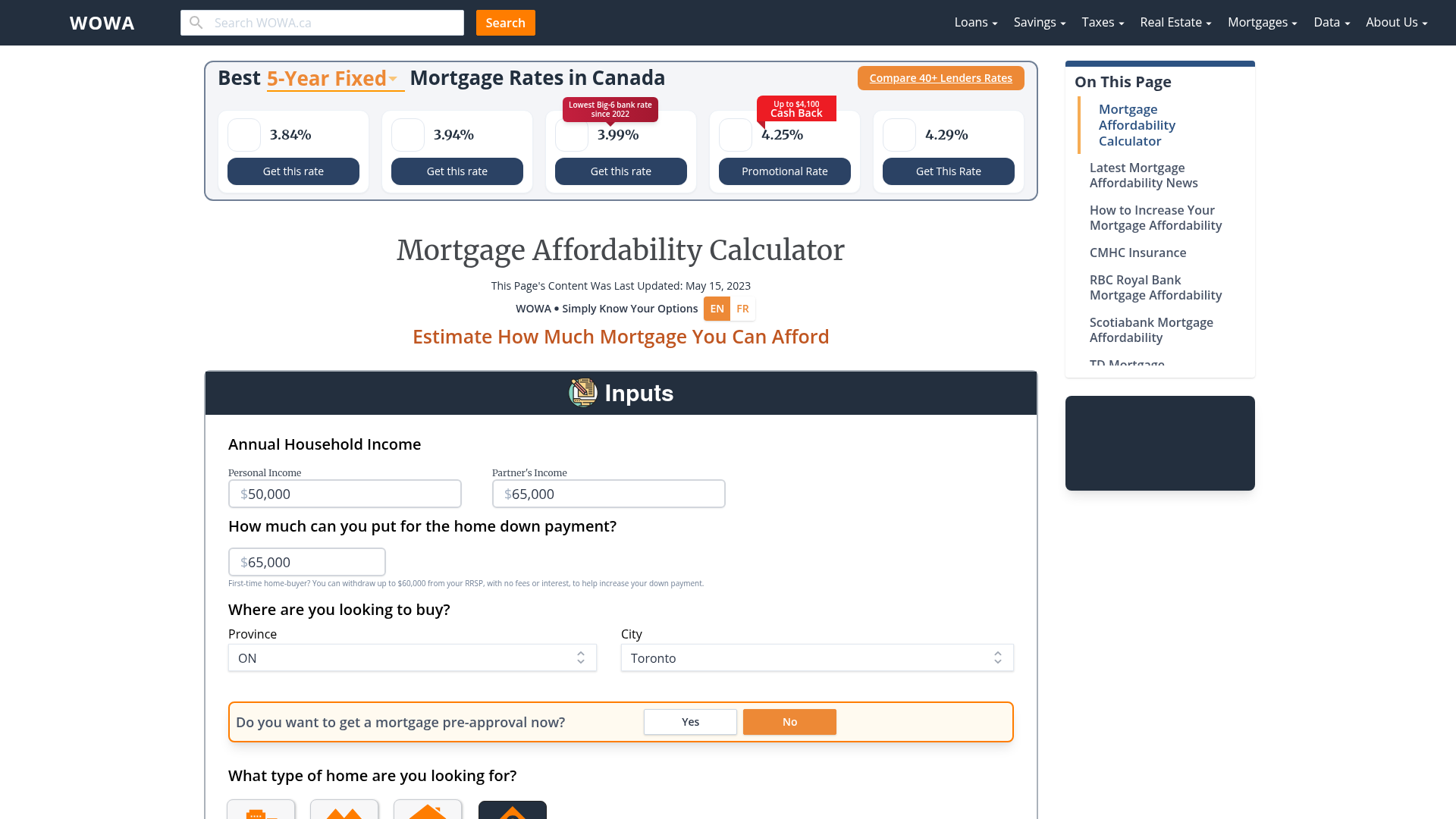

Note that this not an official estimate. Our calculator includes amoritization tables bi-weekly savings. Use our mortgage affordability qualification calculator to estimate how much you can.

You may also come into some more money that you want to put toward your mortgage. The rate table below is automatically configured to show the details for your second loan. FER PITI all other monthly debt payments monthly pre-tax salary.

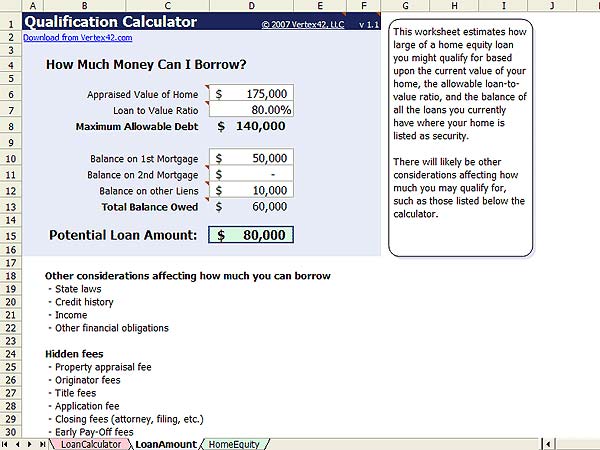

To determine your home equity simply take your current property value and subtract the outstanding loan balance. For example if your home is worth 500000 and your loan balance is 300000 youve got a rather attractive 200000 in home equity. Origination fees closing costs.

Not be satisfied early in lockdowns along with buyers responding to falling interest rates and new needs in a work-from-home. Extra Home Mortgage Payment Calculator. And thats all it takes to use this mortgage calculator with extra payments.

Or FER PITI all other monthly debt payments annual pre-tax salary 12. This calculator has a years before sell setting which is used to run both loans from present until that dateIf you do not plan on selling the home refinancing again at a later date or moving out until after the loan is paid off then set this figure to 30 years so it compares both scenarios after all payments have been made. That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term.

6-12 months worth of cash reserves or savings or at least 2 of the mortgage balance on the rental home. If a home needed significant landscaping before it would fully appeal to you it is something the 203k can help with. To show you how this works lets compare two 30-year fixed mortgages with the same variables.

In most cases they must qualify for refinancing in order to take out a new loan and pay off the reverse mortgage on the home. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year. If you try to sell your home before five or six years or more depending on the terms of your loan you may not recoup all your expenses including your down payment closing costs and Realtor commission fees.

Buying a second house before selling your first home can temporarily leave homeowners with 2 mortgage payments to make each month. If they have enough funds they can settle the loan amount. If you found a home but needed handi-capable access added to move in the 203k is a smart and simple option.

Due to a falling interest rate environment and first mortgages charging lower rates than HELOCs many homeowners have opted for cash out refinancing. Pre-qualification allows you to input basic details about yourself and your desired loan in exchange for a snapshot of the rates and terms offered. Once the equity reaches 20 of the loan the lender does not require PMI.

You may win some money through a raffle or a special trip to the casino. Additional factors to consider when calculating. The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence using cash or liquid assetsLenders typically demand a.

As these are general guidelines only be sure to discuss your lenders specific qualification criteria which. It does nothing for you except put a hole in your pocket. Based on our calculator if you apply for a mortgage with your spouse a lender may grant you a mortgage amount between 211600 to 306600.

According to IRS topic 701 homowners selling their primary residence can often exclude up to 250000 in capital gains on the sale or 500000 if they file jointly with their spouseTo qualify you must have owned the home for at least 2 of the last 5 years leading. Once you have the two numbers and a sense of the interest rate you may qualify for you can use a mortgage calculator to determine the cost of the home that you can afford. How to Calculate a Down Payment Amount.

This lets us find the most appropriate writer for any type of assignment. Most mortgages require the home buyer purchase private mortgage insurance PMIlender in case you default. Second home buyers can also avail of the discounted rates though they will also be required to pay an extra 3 stamp duty.

If you loved a home but needed an extra bedroom added the 203k rolls the cost of adding one into a single payment. How long will I live in this home. 15-year loans build home equity faster whereas 30-year mortgages offer lower monthly payments.

Keys to Consider When Calculating Potential Refi Savings. Home Possible Advantage requires a 3 down-payment but can allow up to 105 financing when combined with a second mortgage. Our second home mortgage calculator uses a maximum debt-to-income ratio of 43 overall which is the maximum amount that many lenders will accept.

So if at all possible save up your 20 down payment to eliminate this. Their Home Possible program requires a 5 down-payment can be used on most types of property using a variety of fixed adjustable rate loan terms. Tips to Shave the Mortgage Balance.

Risks Associated with Reverse Mortgages. For your convenience current Redmond first mortgage rates and current Redmond second mortgage rates are published below the calculator. Capital Gains Considerations When Selling a Home.

Use this free mortgage calculator to get a side-by-side view of multiple loan quotes to select the best offer. If the mortgage balance is higher than the homes value the heir can purchase the house for 95 of the appraised value. Use this calculator to see if this option would save you money on your home loan.

It peaked at 1138 trillion in October 2007 and has fallen below a half trillion dollars in early 2020. For example you may get a great bonus from work at the end of the year or at the completion of a special project. Some home owners obtain a low-rate second mortgage from another lender to bypass PMI payment requirements.

Other mortgage qualification factors. Tend to be slightly higher than primary residence and second home rates. Many home buyers forget to account for closing costs in their cash requirements.

You must qualify based on. This calculator will figure a loans payment amount at various payment intervals - based on the principal amount borrowed the length of the loan and the annual interest rate. 30-Year Fixed Mortgage Principal Loan Amount.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

Home Affordability Calculator For Excel

A Href Https Www Mortgagecalculator Org Calculators Should I Refinance Php Img Src Https Www Mo Refinance Mortgage Refinancing Mortgage Home Refinance

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Fixed Vs Arm Mortgage Loans Mortgage Mortgage Infographic Mortgage Loan Originator

Fha Loan Pros And Cons Fha Loans Home Loans Buying First Home

Getting A Second Mortgage Td Canada Trust

Getting A Second Mortgage Td Canada Trust

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

Getting A Second Mortgage Td Canada Trust

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Mortgage Prequalification Calculator Will I Qualify Mls Mortgage Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Getting A Second Mortgage Td Canada Trust

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Mortgage Affordability Calculator Rbc Royal Bank

Mortgage Qualification Calculator Spreadsheet

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Mortgage Amortization Calculator